The 4-Minute Rule for Financial Advisers

Estate coordinators and bankers might likewise drop under this umbrella. Still, some make a crucial difference because an economic consultant actually offer assistance and also suggestions. As a result, a monetary advisor can be distinguished from an execution stock broker that merely puts trades for customers or a tax accountant that merely prepares tax returns without much input.

A true financial expert should be a well-educated, credentialed, experienced, economic expert who works with part of his customers in contrast to serving the rate of interests of a banks. Typically, an economic expert is an independent professional that runs in a fiduciary capacity in which a client's interests come prior to their own.

There are some agents and also brokers who attempt to practice in this capability. Nevertheless, their settlement framework is such that they are bound by the contracts of the business where they work. Given that the implementation of the Investment Adviser Act of 1940, two kinds of connections have existed between financial middlemans and their customers.

Some Of Pension Advisers Edinburgh

There is a fiduciary relationship that calls for consultants registered with the Stocks as well as Exchange Payment (SEC) as Registered Financial investment Advisors to exercise tasks of loyalty, care, and full disclosure in their interactions with clients. While the former is based on the concept of "caution emptor" assisted by self-governed policies of "suitability" as well as "reasonableness" in suggesting an investment product or strategy, the latter is grounded in government laws that enforce the highest ethical standards.

For several years, IFAs were paid in either ways - either by charges (you paid upfront) or payment (they took a recurring cut, which varied per product). By regulation they were required to provide you the option of either - Financial Adviser Edinburgh. But since 31 December 2012, IFAs have been banned from accepting payment from carriers on items, such as financial investments as well as pensions.

All consultants can still approve commission from companies for life, crucial illness and also earnings defense insurance coverage, and also home mortgage broking. Below, advisers take a cut on a monthly basis that the item is held. This may appear free to you, however your cash still pays them, simply over a longer period rather than in advance - as well as it commonly amounts to a much higher price.

How Wealth Management Edinburgh can Save You Time, Stress, and Money.

Typically the initial meeting or discussion with a financial consultant where they learn what kind of products you need is totally free, yet inspect just in case you obtain landed with a costs (Independent Financial Adviser). From after that on, you'll need to pay. You can do this in three means, relying on which consultant you pick:: This is the most typical means for advisors to bill, possibly because it most closely resembles how they made use of to charge under the payment version.

You'll normally pay a first portion fee for coming to be a customer and also investing your cash, after that a continuous percent fee for every year that they remain to handle your cash. This portion can vary anywhere from 0.5% to 5%, so ensure you ask.: These costs are billed each time you go to the advisor for different 'projects', such as combining your pensions, or investing.

: Some advisers are relocating even more to a design which appears like solicitors or accountants and charging on a hourly basis. If you choose to drop this route, make sure you're offered a full failure of the job they have actually done and just how lengthy it took. Per hour fees can be anything from in between 50 to 250 a hr, so ensure you ask before you go in advance.

6 Simple Techniques For Independent Financial Adviser

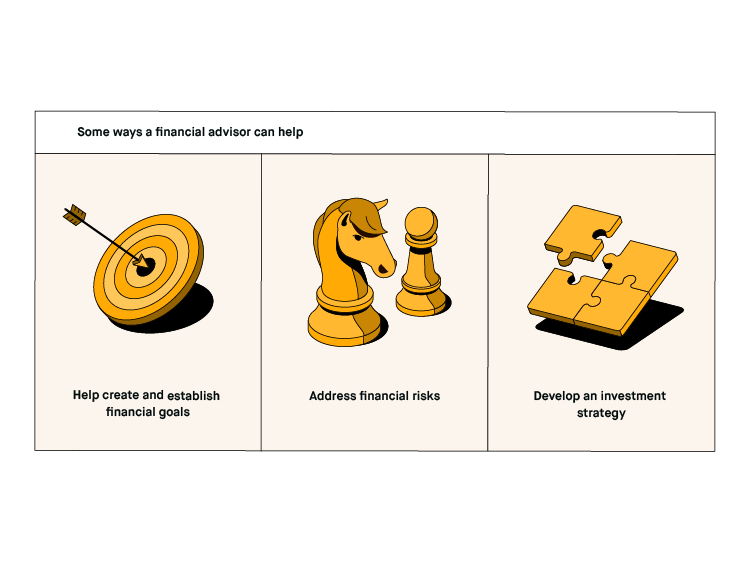

Financial experts assess the monetary demands of people and also aid them with investments (such as supplies and bonds), tax legislations, and also insurance coverage decisions. They help clients prepare for short-term as well as long-lasting objectives, such as education and learning costs and also retirement. They suggest investments to match the customers' goals. They spend clients' cash based on the clients' choices.

Personal monetary experts generally do the following: Meet customers in person to review their economic goals Describe the kinds of monetary services they supply Inform customers as well as answer concerns concerning financial investment choices and prospective risks Advise investments to clients or select financial investments on their behalf Help clients plan for particular circumstances, such as education expenditures or retirement Monitor customers' accounts and figure out if changes are required to boost account efficiency or fit life modifications, such as marrying or having youngsters Study financial investment opportunities Although a lot of monetary consultants provide recommendations on a large range of subjects, some concentrate on areas such as retired life or risk monitoring (assessing exactly how willing the capitalist is to take possibilities, and also readjusting financial investments accordingly).

They check the customer's financial investments and generally consult with each client a minimum of as soon as a year to upgrade him/her on prospective financial investments and also to adjust the financial plan because of the customer's changed situations or because investment options have changed (Financial Adviser Edinburgh). Numerous economic advisors are certified to straight acquire as well as offer financial items, such as supplies, bonds, annuities, and insurance policy.

4 Easy Facts About Pension Advisers Edinburgh Described

Personal bankers or wealth managers are individual financial advisors who benefit individuals who have a great deal of money to invest. These customers are comparable to institutional financiers (generally companies or companies), and they come close to spending in a different way from the general public. Personal lenders manage a collection of financial investments (called a profile) for these customers by using the resources of the bank, consisting of teams of financial analysts, accounting professionals, and various other specialists.

They satisfy possible clients by giving seminars or via service as well as social networking. There are a range of economic experts that are educated to use specific monetary advice - Financial Adviser Edinburgh. The adhering to are four kinds of financial advisors readily available to the public, and also information on the sorts of solutions they give: Financial experts as well as financial organizers are frequently used mutually.

visit the website click reference check this